2025 Property Tax Information

Published on June 02, 2025

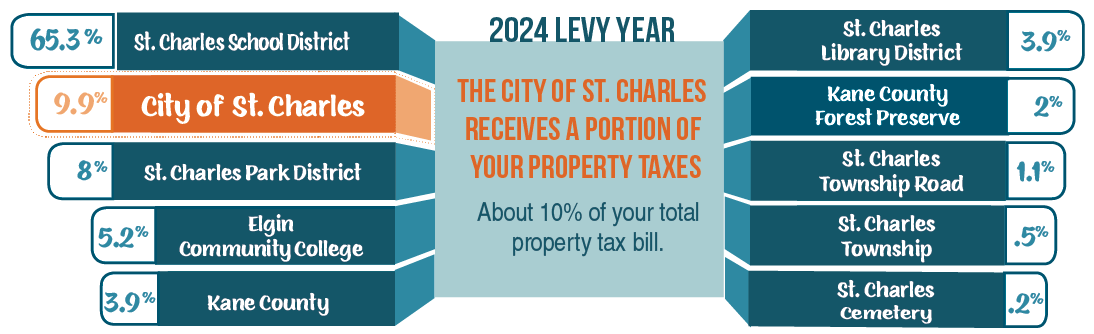

The City is one of ten different taxing bodies itemized on your property tax bill. The City’s portion of your entire property tax bill is about 10 percent.

Review Your Property Tax Bill

To see your property tax bill and the breakdown of how much goes to which taxing body, visit Kane County Treasurer and click on “Print a Property Tax Bill.” There you can input your name and address, (or parcel number if you know it) to access an itemized tax bill to review. Taxes related to the City are labeled “St. Charles City.”

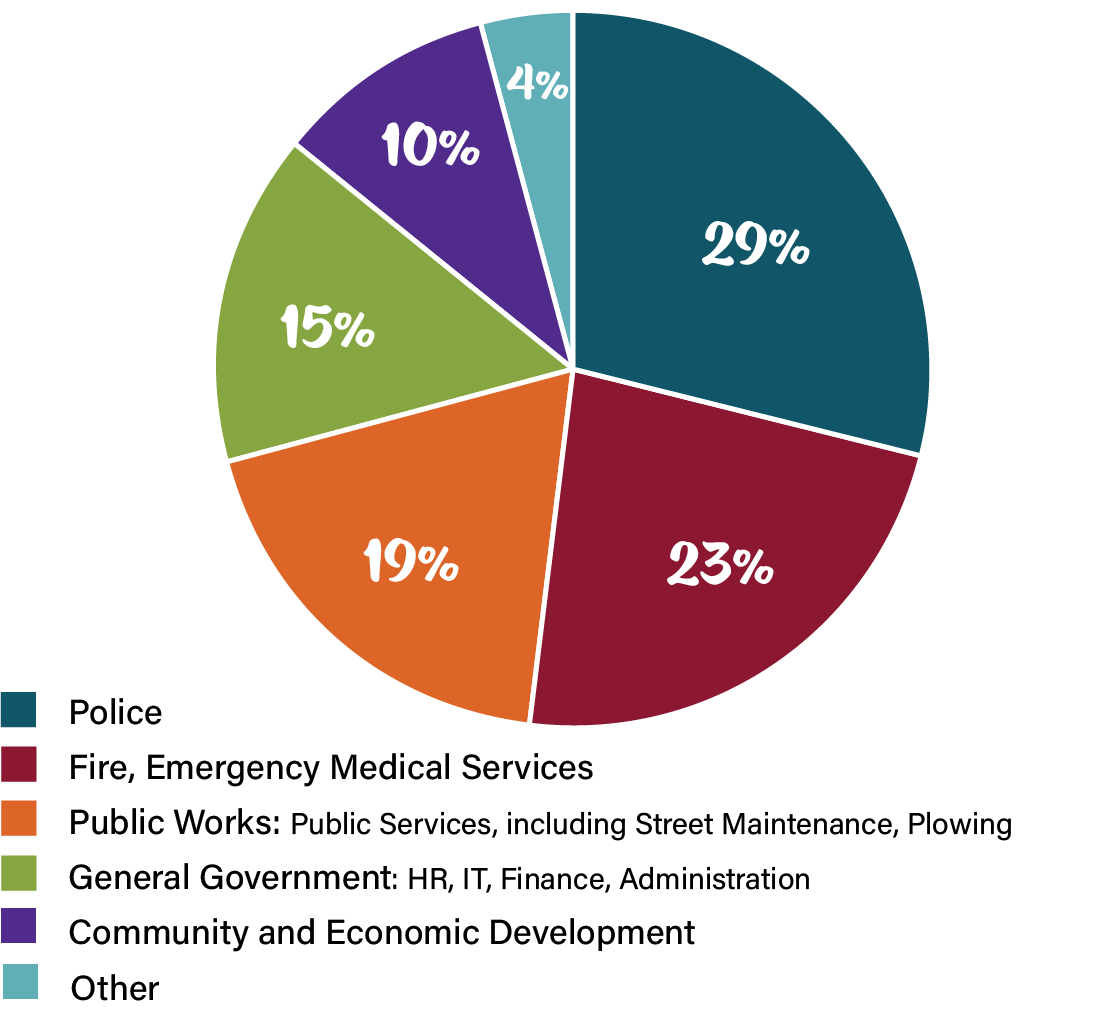

What the City's Portion of Property Taxes Helps Pay For

Last year, a resident in a $300K home paid $675 to the City. (About 10% of the total property tax bill.) That helps pay for a full year of City Services. Electric, Water, and Wastewater Services are not paid with property taxes. Those are paid for with usage fees.